US producer prices climbed more than anticipated in December, driven primarily by a rise in service prices.

The Producer Price Index for final demand rose 0.5% month-on-month, accelerating from a 0.2% increase in November and surpassing economists’ expectations of a similar rise.

On an annual basis, producer prices increased 3%, unchanged from the previous month.

Services lead the price increase

The stronger-than-expected increase in producer prices was driven largely by services, which rose 0.7% in December.

Trade services played a particularly prominent role, with margins for wholesalers and retailers climbing 1.7%, accounting for roughly two-thirds of the increase in services prices.

More than 40% of the rise in final demand services was linked to a sharp jump in margins for machinery and equipment wholesaling, highlighting how supply chain adjustments and tariff-related costs are filtering through the economy.

Goods prices show mixed trends

Prices for final demand goods were flat in December after rising in November, reflecting divergent movements across categories.

Gains in goods excluding food and energy offset declines in energy and food prices.

Nonferrous metals recorded a notable increase, while prices also rose for residential natural gas, motor vehicles, soft drinks, and aircraft and related equipment.

At the same time, diesel fuel posted a steep decline, with gasoline, jet fuel, beef and veal, and iron and steel scrap also moving lower.

The mixed pattern underscores how inflationary pressures remain uneven, with certain sectors absorbing cost increases while others experience falling prices.

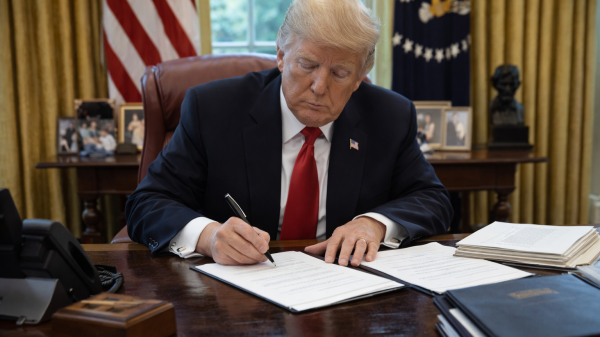

Tariffs and policy outlook in focus

Businesses had previously absorbed part of the impact of sweeping import tariffs, helping to contain inflation.

The latest data, however, suggest that firms are increasingly passing on these costs, raising the risk of broader price pressures.

The Federal Reserve recently kept its benchmark interest rate unchanged, with policymakers continuing to weigh the impact of tariffs on inflation.

Fed Chair Jerome Powell has noted that tariff-driven inflation could peak later in the year, implying that price pressures may intensify before easing.

Producer price data are closely watched by economists because several components feed into the personal consumption expenditures price index, the Federal Reserve’s preferred measure of inflation.

The December PCE figures, delayed by earlier disruptions, are scheduled for release later this month, adding uncertainty to the near-term inflation outlook.

Data delays add to uncertainty

The Bureau of Labor Statistics has now caught up on producer and consumer price reports that were delayed during the recent federal government shutdown.

However, lawmakers are again racing to avert another shutdown, which could disrupt upcoming data releases, including the next employment report.

As tariff effects begin to surface more clearly in producer prices, investors and policymakers alike are bracing for a potentially more volatile inflation trajectory in the months ahead.

The post US producer prices jump more than expected in December as services costs surge appeared first on Invezz