Three years ago, Cambodian Prime Minister Hun Sen presented a collection of locally crafted wristwatches to world leaders, including Joe Biden, Justin Trudeau and Anthony Albanese.

Each watch bore the logo of Prince Holding Group, a conglomerate headed by Chen Zhi, a China-born entrepreneur who had reinvented himself as a Cambodian philanthropist and developer.

The watches, adorned with 25 jewels, symbolised Cambodia’s ambitions to gain international recognition. Today, they serve as reminders of an empire accused of laundering billions through forced-labour scam compounds.

Building a façade of legitimacy

Born in 1987 in Fujian, China, Chen Zhi began his career in gaming before turning to real estate. By 2011, he had moved to Cambodia and founded Prince Group, whose interests spanned construction, finance, hospitality and aviation.

Over the next decade, Chen cultivated political ties at the highest levels, becoming an adviser to Hun Sen and later to his son and successor, Hun Manet.

Through lavish philanthropy and strategic partnerships, Chen positioned Prince Group as a driving force in Cambodia’s development.

Its projects included the $16 billion Ream City development, later renamed the Bay of Lights, intended to transform Sihanoukville into a regional hub.

Singaporean and European firms signed on, and luxury hotel brands such as Radisson and Ascott announced partnerships.

Chen’s network extended well beyond Cambodia. He acquired multimillion-dollar properties across Singapore, London and Hong Kong.

His Singapore holdings alone included penthouses worth more than S$30 million, a luxury yacht moored off Sentosa, and a family office, DW Capital Holdings, that reportedly managed S$60 million in assets.

A web of global influence

At international summits, Chen’s watchmaking school produced the timepieces gifted to world leaders. In London, he owned a £100 million office building in the City and multiple luxury apartments.

In Taiwan, his companies spent NT$3.8 billion on real estate, and in Hong Kong, Prince-linked entities controlled more than $300 million in assets, including stakes in two publicly listed firms, Geotech Holdings and Khoon Group, both now under US sanctions.

Chen also secured multiple citizenships, including those of Cyprus, Vanuatu and Cambodia, allowing him to move funds and personnel across jurisdictions.

He created investment companies in Singapore that handled car loans, co-working spaces and duty-free warehouses, legitimate-looking enterprises that prosecutors now say concealed large-scale money laundering.

Collapse under international scrutiny

The façade crumbled in mid-October when the US and UK governments sanctioned 146 individuals and entities linked to Prince Group.

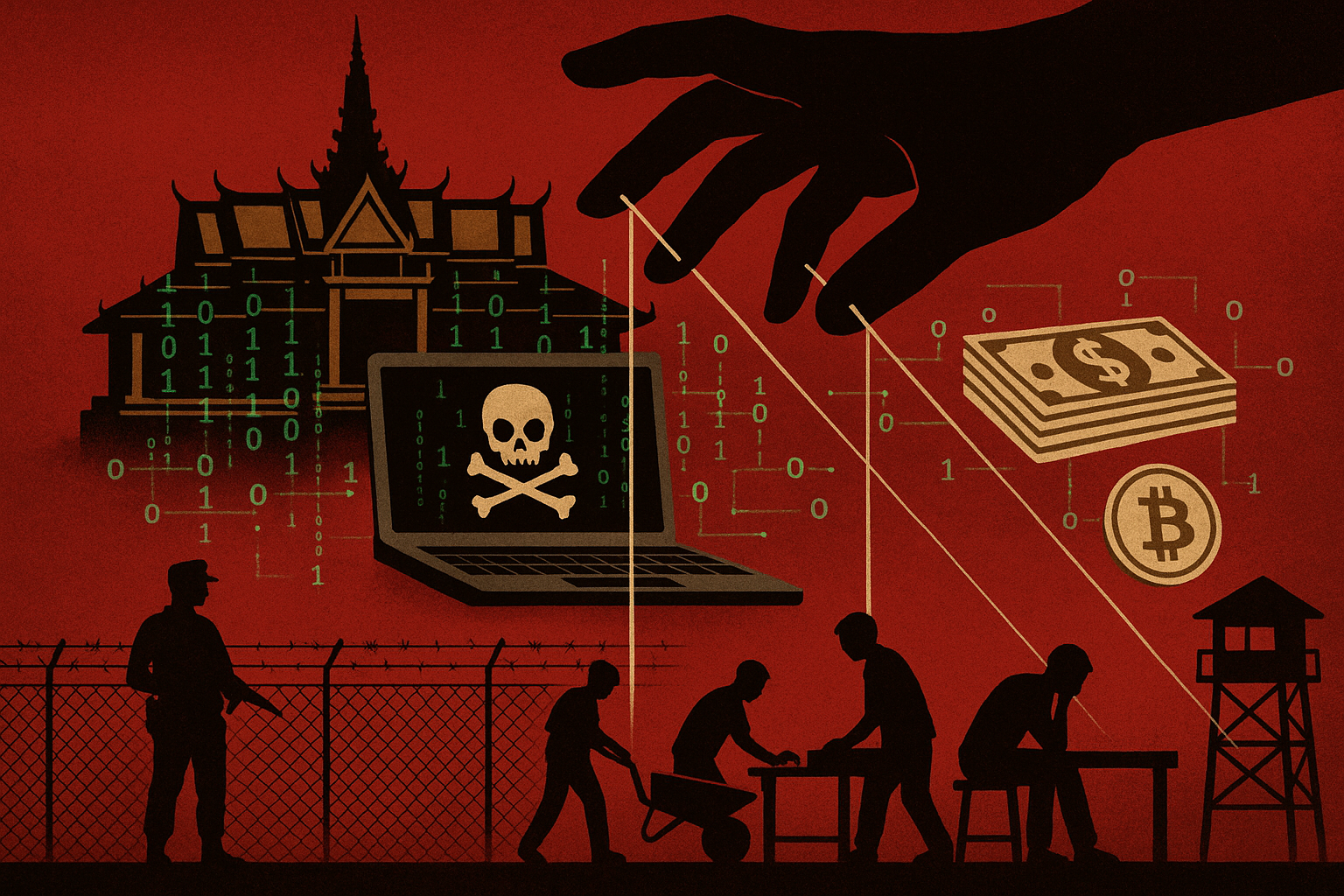

Authorities alleged that Chen’s network operated transnational scam compounds across Southeast Asia, using trafficked workers to run investment frauds and romance scams.

US prosecutors seized $15 billion worth of bitcoin, describing the operation as one of the largest forced-labour-based financial crimes on record.

Singapore police launched enforcement actions, seizing S$150 million in assets and freezing accounts, vehicles and luxury goods.

London authorities froze Chen’s properties, while regulators in Hong Kong, Taiwan and Cambodia began their own probes. The Monetary Authority of Singapore confirmed that banks had flagged suspicious transactions as early as last year.

Despite mounting evidence, Prince Group continued to attract partners until sanctions took effect.

Ascott Ltd and Radisson Hotel Group both withdrew from the Bay of Lights project only after the US Treasury placed Canopy Sands, Prince’s development arm, on its sanctions list.

Global lessons in complicity

Chen’s ability to embed his empire in respected financial hubs exposes deeper flaws in the international regulatory system. For more than a decade, his operations thrived in jurisdictions that prided themselves on transparency and compliance.

Experts suggest that the group exploited gaps in cross-border oversight, using political access and the free flow of capital to mask criminal activity.

Harvard University’s Jacob Sims noted that Prince Group’s rise “almost certainly thrived more fully because of the openness and ability to move capital in and out of places like Hong Kong and Singapore.”

The global response, he argued, bordered on complicity.

For Cambodia, the case has broader implications. The government now faces pressure to prove its financial system can curb cross-border scams, which have damaged the country’s international reputation.

The scandal has also renewed scrutiny of Southeast Asia’s scam-compound economy, where forced labour, cybercrime and cryptocurrency flows often intersect.

What began with a gilded gift of luxury watches has ended with the exposure of a network accused of enslaving workers and defrauding victims worldwide. Chen Zhi, once hailed as a model of modern Asian entrepreneurship, remains at large.

His empire, built on the illusion of legitimacy, now stands as a symbol of how global finance and weak oversight can sustain even the darkest of enterprises.

The post From luxury watches to scam compounds: the rise and fall of Chen Zhi’s global empire appeared first on Invezz