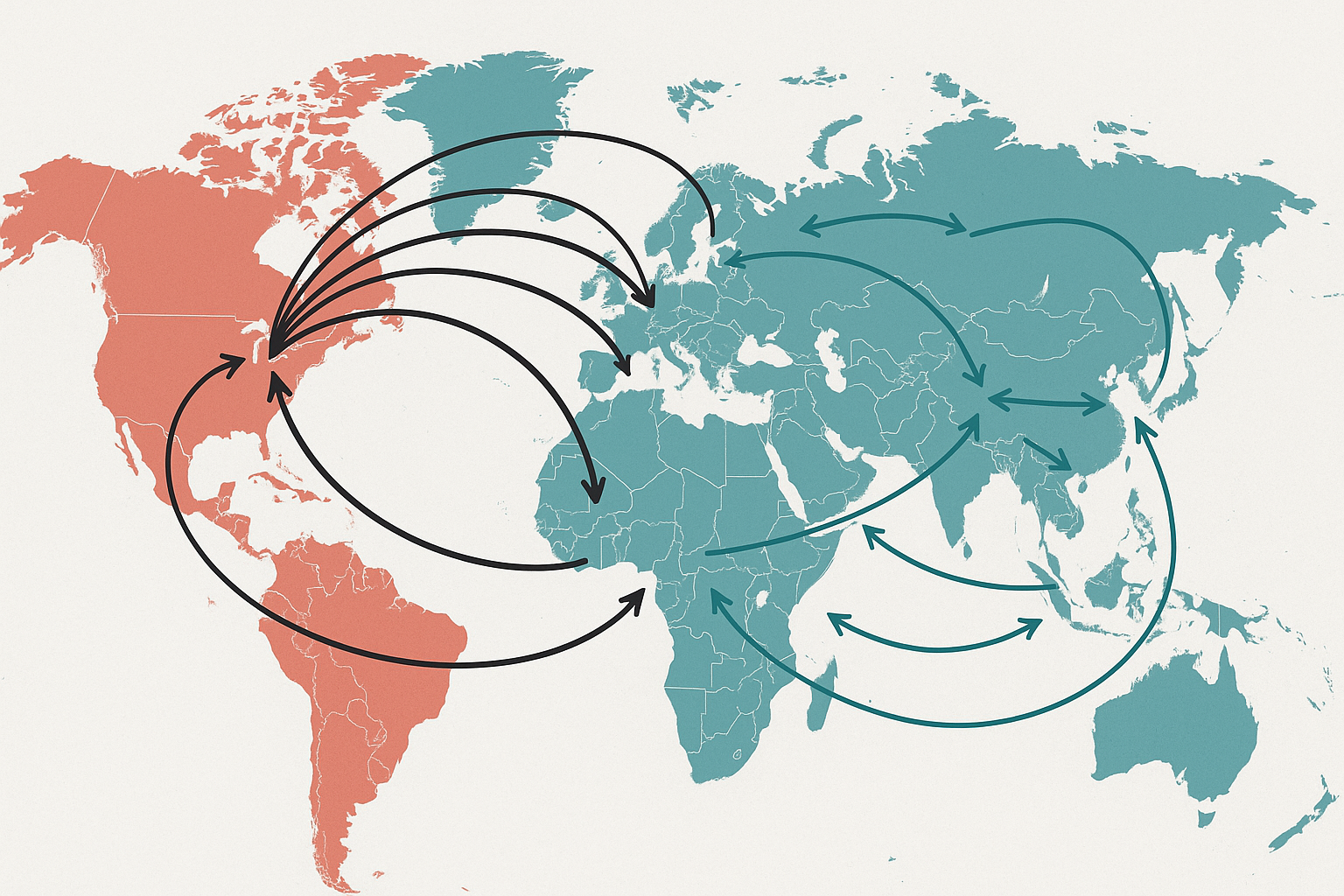

The world economy is entering a new phase of diversification. Countries that once depended heavily on US markets are now forming fresh alliances, rerouting supply chains, and looking to other partners to offset record-high tariffs.

From Canada sourcing vehicles from Mexico instead of the US to China buying soybeans from South America, global commerce is shifting focus.

Bloomberg reports that despite the United States’ protectionist measures — the steepest tariffs since the 1930s — global trade is not slowing down.

Instead, 85% of it now flows through alternative channels, proving that the world economy is adapting rather than contracting.

The World Trade Organization (WTO) recently raised its forecast for merchandise trade growth in 2025 to 2.4%, up from 0.9%, signalling renewed momentum.

Why countries are forming new trade alliances

According to Bloomberg, Tariffs imposed by Washington have pushed trading partners to look elsewhere.

Canada’s car imports from Mexico have surpassed those from the US, while China has turned to South American growers for soybean supplies.

India and China have resumed direct flights and rare-earth trade after years of suspended relations, showing how even long-standing rivals are choosing cooperation for mutual economic gain.

Smaller economies are also realigning their trade paths. Peru is marketing its blueberries to Asia, and Lesotho, known for textile production, is targeting Europe, Africa, and Asian markets.

At the same time, 14 nations — including New Zealand, Singapore, Switzerland, and the UAE — have formed a new partnership to boost investment and trade.

These shifts highlight a broader trend: countries are prioritising resilience and diversification over dependence on the US. As a result, regional blocs and bilateral deals are now driving global growth.

How trade flows are being redirected

The impact of these changes is visible in shipping and logistics data. Bloomberg states that Chinese manufacturers, facing US tariffs, are expanding their reach across new regions.

International Container Terminal Services Inc., a port operator based in Manila, reports stronger cargo activity to non-US destinations as global shipping lanes are rebalanced.

China’s August trade data underlines this change. Exports to the US plunged 33%, but shipments to Southeast Asia rose 23%, to the EU climbed 10%, and to Africa increased 26%.

Experts expect China to post a record $1.2 trillion trade surplus this year despite the downturn in transpacific shipping, which is projected to contract by nearly 3%.

Bloomberg notes that maritime data firm Clarksons Plc forecasts moderate growth across most other global routes.

This suggests that while the US-China trade corridor is shrinking, other lanes — particularly Asia-to-Europe and Africa-bound routes — are growing steadily.

The redistribution of shipping activity shows how companies are finding new customers and suppliers to maintain business continuity.

How Europe and smaller nations are adapting

The European Union is among the most active in reshaping its trade network. Brussels is accelerating long-delayed trade deals, including a 25-year-old agreement with Mercosur, a South American bloc representing 780 million consumers.

The EU has also finalised a free-trade agreement with Indonesia and revived talks with Australia, seeking to expand its list of 76 existing trade partnerships.

These efforts indicate that Europe aims to fill trade gaps created by geopolitical fragmentation. However, experts caution that smaller nations may find it harder to compete in this new order.

As global trade becomes more regional, countries without economic influence risk losing the benefits of the WTO’s rules-based system.

As per a Bloomberg report, Timor-Leste, the WTO’s newest member, symbolises both opportunity and vulnerability.

With a population of 1.4 million and GDP per capita around $1,300, it hopes WTO membership will help diversify its oil-dependent economy by exporting coffee, vanilla, and fruit.

Meanwhile, companies are also adjusting. US-based True Places, which manufactures outdoor chairs in Cambodia, has halted imports to the US due to tariff pressures and is now targeting overseas customers.

The move reflects a growing pattern of firms globalising production and sales to survive in a fragmented trade landscape.

The post How global trade is changing as nations move away from the US appeared first on Invezz