Indian IT stocks slumped on Monday after US President Donald Trump announced an overhaul of the H-1B visa programme, imposing a hefty $100,000 fee on new applications.

The surprise move threatens to upend the long-standing outsourcing model that Indian IT majors rely on to serve their biggest market.

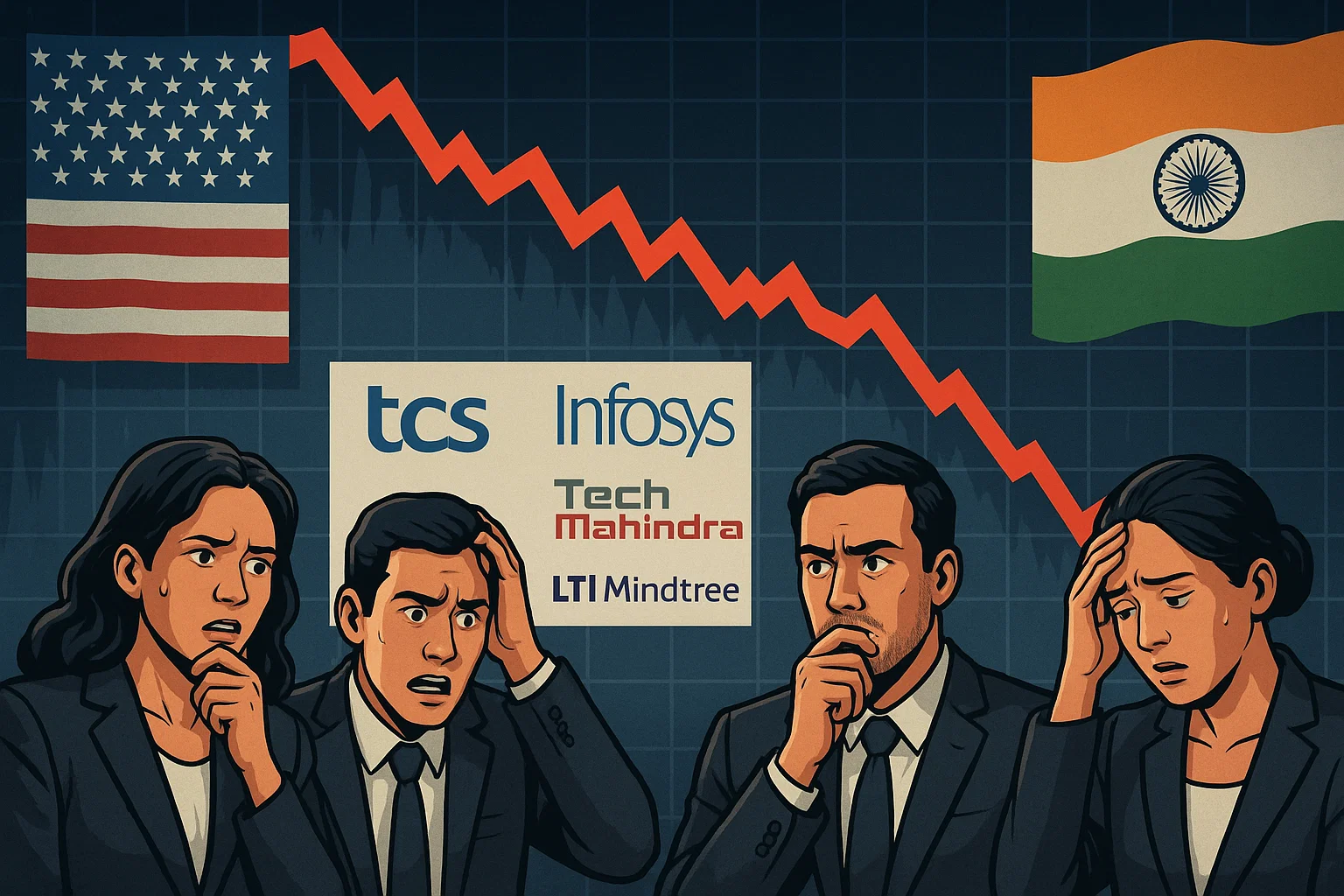

Shares of Tata Consultancy Services, Infosys, and Tech Mahindra led sharp declines, as investors worried about rising operational costs and shrinking margins.

The selloff underscored how vulnerable India’s export-driven IT sector remains to regulatory shocks from Washington, even as firms have tried to reduce their reliance on the controversial visa route over recent years.

US H-1B visa fee shock rattles IT stocks

Donald Trump’s plan quickly reverberated across Dalal Street, prompting a broad selloff in Indian IT stocks.

Tata Consultancy Services fell as much as 3.4% intraday, its steepest slide in more than two months, before trimming losses.

Infosys shares tumbled 3.9%, while Tech Mahindra suffered the biggest blow with a 6.5% drop.

Mid-tier firms fared no better, with LTIMindtree and Mphasis both shedding about 6% each.

The beating came against the backdrop of already fragile sentiment: a sectoral index tracking IT companies is down more than 15% this year through September 19, making it the worst performer on the National Stock Exchange, in contrast to the Nifty 50’s 7% rise.

For investors, the connection to Trump’s visa fee was clear. Indian IT firms have historically sent thousands of engineers on H-1B visas to work with US clients directly, a cost-efficient model that kept margins robust.

A $100,000 fee per visa application would smash that calculus, forcing firms either to pay up for onshore roles or to overhaul delivery to offshore centres, neither of which looks margin-friendly in the near term.

The developments added to a string of pressures for the industry, which has already been grappling with weaker earnings, reduced client spending, and layoffs at top firms.

Analysts see midcaps more exposed, risks lingering

Bloomberg News quoted several market analysts who remain split on how deep and lasting the damage could be.

According to Citi strategists, the true financial impact will surface over the next couple of years, with fiscal 2027 set to feel the brunt.

Companies such as HCL Technologies and Infosys, which have already built more visa-independent workforces in the US, could weather the storm better than smaller peers. But even for large caps, higher onsite costs are difficult to avoid.

JPMorgan analyst noted that companies may increasingly turn to near-shoring in Canada or Mexico, or opt to substitute H-1B workers with local US staff.

Brokerage Investec cautioned that midcaps face the sharpest pain, given their higher reliance on visas.

Litigation is one potential reprieve: immigration advisors suggested the new fee could face court challenges, which might offer temporary relief.

Still, Emkay economist framed the move in broader terms, saying India’s services exports had been pulled squarely into the trade war crossfire.

For now, IT valuations will carry a higher risk premium, and investors appear braced for more volatility ahead.

The post Indian IT stocks crash as Trump’s $100K H-1B visa fee sparks market turmoil appeared first on Invezz