The AUD/NZD exchange rate held steady on Tuesday and was about to form a golden cross after the Reserve Bank of Australia (RBA) delivered its interest rate decision. It was trading at 1.0965, up by nearly 3% from its lowest level this year.

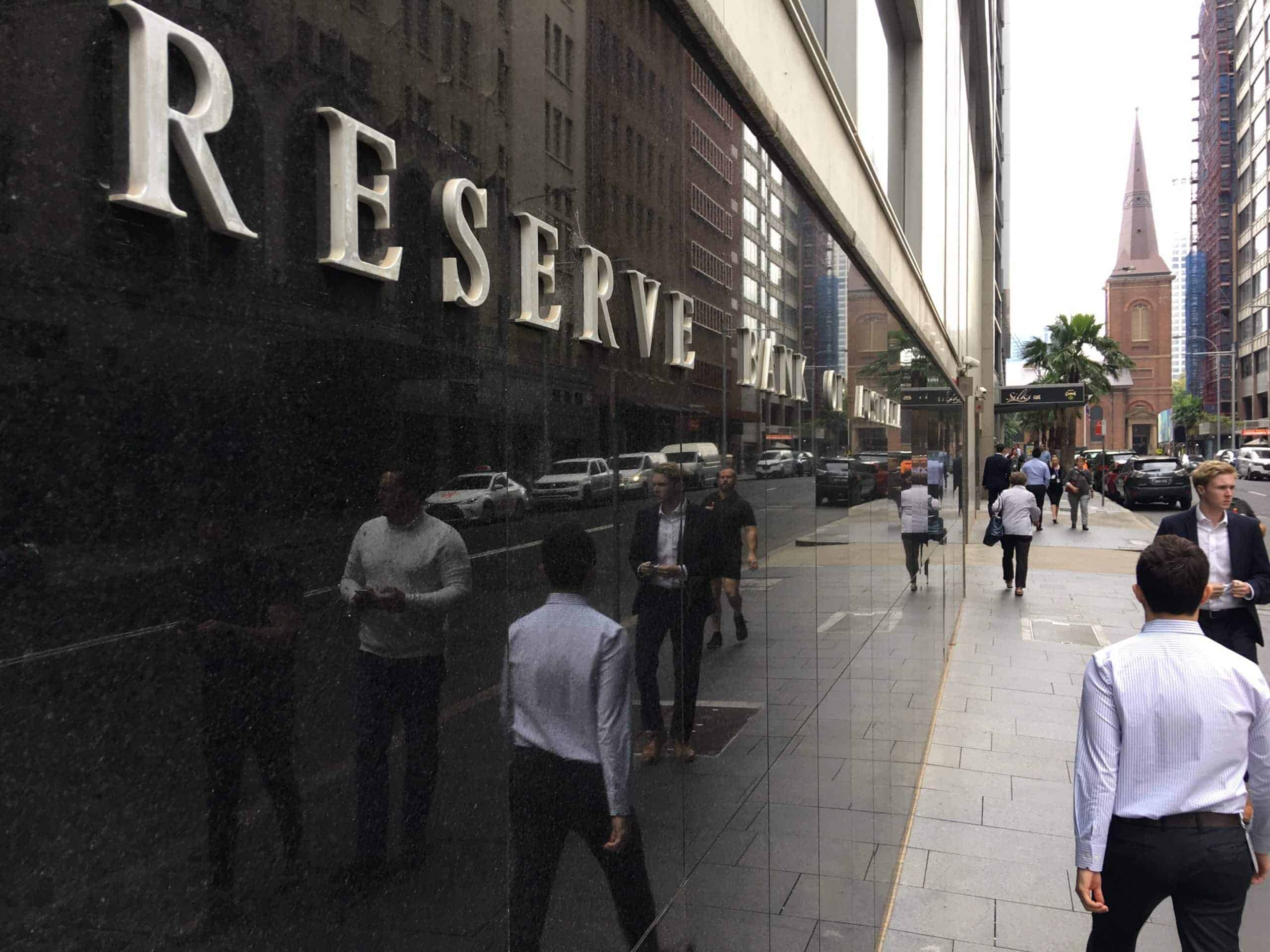

RBA interest rate decision

The AUD/USD exchange rate rose following the RBA’s interest rate decision, which aligned with the expectations of most analysts. It slashed interest rates by 0.25%, bringing the official cash rate to 3.60%. It was the third rate cut since last year.

In his statement, the bank noted that it was still concerned about the Australian economy as the ongoing trade conflict between the US and top countries continue.

The rate cut came a month after the bank caught market participants off guard by leaving interest rates unchanged at 3.85%. In a statement, the RBA said:

“The Board nevertheless remains cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and potential supply.”

Analysts expect the bank to continue cutting interest rates in the coming months as the economy slows and inflation moves downwards. In a note, a Bloomberg analyst said:

“The sluggish growth and inflation outlook incorporates the RBA’s assumption for 70 basis points of additional easing. We think it will have to go further, and see 100 basis points of rate cuts over the next 12 months.”

The RBA also expects the economic growth to be softer than previously expect. Its growth will be between 2% and 3% this year as the trade uncertainties continue.

The next important catalyst for the AUD/NZD exchange rate will be the upcoming Australian Wage Price Index data. Economists expect the data to show that the index slowed from 0.9% in Q1 to 0.8% in Q2, leading to an annual figure to move from 3.4% to 3.3%.

Wage growth is a crucial indicator due to its impact on inflation. In most cases, strong wage growth leads to higher inflation over time.

The other crucial data to watch will be the upcoming Australian jobs data on Thursday. Economists see the report showing that the participation rate remained at 67.1% as the economy created just 2,000 jobs.

RBNZ likely to cut interest rates

The next important catalyst for the AUD/NZD will be the upcoming RBNZ interest rate decision on August 22. Like the RBA, the bank left interest rates unchanged in the last meeting, pausing after six straight cuts.

It left the cash rate at 3.25%, but hinted that it will continue cutting in the coming meeting. In this case, the most likely scenario is one where rates are slashed to 3% as concerns about the economy persist. Economists see the official cash rate ending the year at 2.75%.

AUD/NZD technical analysis

The daily chart shows that the AUD/NZD exchange rate has drifted upwards in the past few months. It moved from a low of 1.0653 in May to the current 1.0960.

The pair has already crossed the 50-day and 200-day moving averages and is about to have a golden cross pattern. A golden cross normally leads to more upside over time.

If this happens, the pair will likely continue rising as bulls target the key resistance point at 1.1050. A move above that level will point to further gains, potentially to the resistance at 1.1181, its highest point in February this year. A drop below the 200-day moving average will invalidate the bullish AUD/NZD forecast.

The post AUD/NZD forecast: golden cross nears after the RBA rate decision appeared first on Invezz